Thoughts on the Compliance Job Market

Today I want to revisit the state of the job market for compliance professionals, and will start with some breaking news: the market is still a big, roiling mess of uncertainty that’s driving everyone bananas.

OK, you probably knew that already — but if we all want to preserve our sanity, it’s important for compliance officers to understand why the job market is such a mess.

This issue has been on my mind for several weeks, ever since I sat down with Adam Turteltaub on the Compliance Perspectives podcast to talk about it. As I said then, I wouldn’t describe today’s job market for compliance officers as bad. On the contrary, I believe the skills and capabilities that a compliance officer can bring to an organization are more important than ever.

At the same time, however, plenty of compliance officers find today’s job market excruciatingly difficult, and your perceptions are accurate too. The job market today is a confounding place for compliance officers.

Why? Let’s consider a few factors.

Industry Size: Unknown

First, nobody knows how large the ethics and compliance field actually is. We have no clear definition for who qualifies as an “ethics and compliance professional,” and no reliable number for how many people work in those jobs — and if we don’t know how large the field is, we can only make vague guesses about whether the market is getting bigger or smaller.

For example, we could assume that a compliance professional is anyone who (a) is employed by a corporation; and (b) and has “corporate compliance” in their title. So what about a corporate lawyer who handles regulatory compliance and investigations? What about an internal auditor who also handles ethics and compliance issues as necessary? What about a law firm lawyer who consults on building ethics and compliance programs, or a consultant who drafts ethics training materials? What about someone who moves back and forth and back again among all those roles?

I’d argue that all of those people would qualify as compliance professionals. And while we can get an approximate sense of how many people are in some of those roles, we can’t get an accurate sense of how many people are in all of those roles.

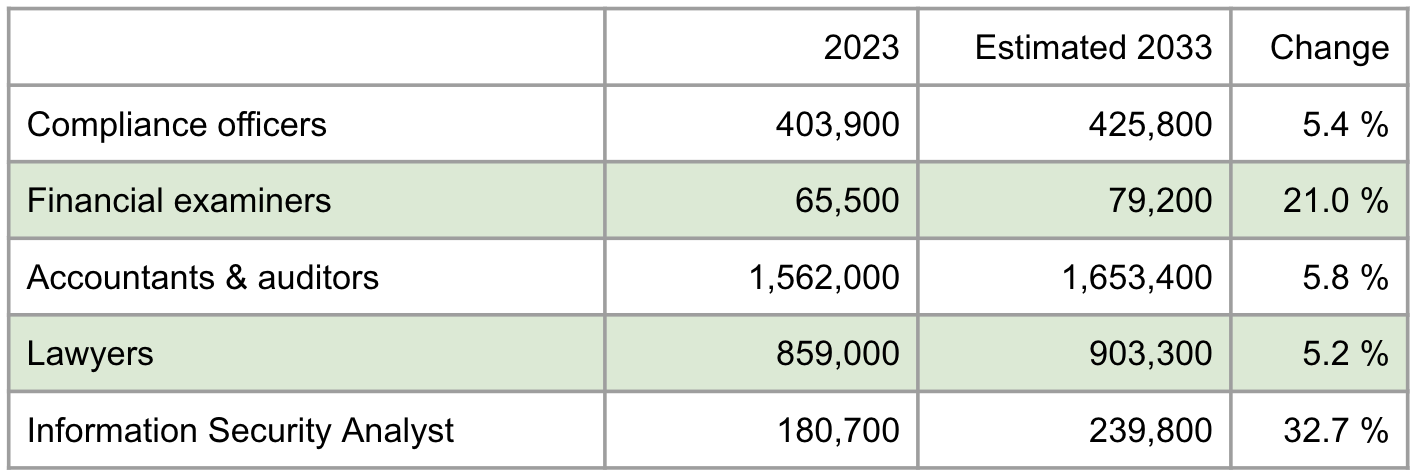

A while back I did consult the U.S. Bureau of Labor Statistics to see estimated career growth in various compliance-ish fields. The results are in Figure 1, below.

Source: BLS

Now come the caveats. BLS defines “compliance officers” as people who…

Examine, evaluate, and investigate eligibility for or conformity with laws and regulations governing contract compliance of licenses and permits, and perform other compliance and enforcement inspection and analysis activities not classified elsewhere.

That kinda sorta sounds like what an ethics and compliance officer does, although it also feels like it misses a lot of the job. Meanwhile, I did include auditors, lawyers, and IT analysts in Figure 1 because clearly at least some of them handle ethics and compliance issues; but those BLS numbers don’t tell us exactly how many. And of course, none of those numbers include compliance officers elsewhere in the world, who all should be in the total too.

So if we want to understand how good, bad, or difficult today’s job market is, we should ask, “Compared to what?” — except, nobody knows.

Searching for a Job Does Suck

Another point I emphasized in my conversation with Turteltaub is that there’s a difference between a job market that’s bad, where we have fewer and fewer jobs available; versus a job market that’s difficult, where it takes forever and a day to find new employment.

I would argue that we are in the latter, rather than the former. Blame the AI and automation technology.

For example, lots of compliance officers looking for work these days will say, “I have stellar qualifications and applied to 700 jobs, and haven’t received a call back for a single one! Is nobody at all interested in me?”

Well, consider that…

- Some portion of job postings will be perfunctory; the company already has a candidate in mind but is obligated to advertise the role to tick some box in the HR policy manual.

- Some portion of job postings will be fake; a fraudster created the posting to harvest personal data from applicants.

- In the same way that you can now apply for 700 jobs by clicking a button that says “instant apply,” so can everyone else looking for a job. So when a legitimate recruiter does post a legitimately open job, the recruiter could easily be overwhelmed with thousands of responses.

- AI now makes it easier than ever for job applicants to craft cover letters and resumes that match a job posting perfectly. So when that legitimate recruiter is overwhelmed with thousands of responses, plenty of them will look fantastic.

Those are just the ways that technology is introducing friction into the hiring process. On top of that, we still have plenty of other factors, too.

For example, the economy isn’t outright bad, but it is fraught with uncertainty thanks to President Trump’s tariffs and other erratic economic policies. Given that uncertainty, you can’t blame CFOs for wanting to be as frugal with new spending as possible. Hence we don’t see mass layoffs, although new hiring has slowed to a trickle. Hence we see senior management asking, “Can’t we get this work done with AI instead?” Hence approval processes are long and tortured. And yes, age discrimination is a thing too.

When you look at that full picture, with economic uncertainty as the foundation and then modern technology clogging the arteries of the hiring process, then of course a person can apply for 700 jobs and maybe get two responses, which will both take five months to reach a decision if you’re lucky.

For the individual applicant, skilled and well-qualified and who’s at the brink of tears as you apply for the 701st time, it still sucks. For the hiring manager swamped by 10,000 applications, it sucks too (albeit in a less urgent and painful way). We are trapped in a straitjacket of technology and processes that don’t serve anyone’s interests.

But Compliance Capabilities Still Matter

So with all that gloom about landing a compliance job these days, why am I still bullish about compliance roles in the long term?

Because the capabilities that a compliance officer can bring to an organization will still be tremendously valuable over the long term — even in our deregulatory, light enforcement environment, and even as the specter of slow growth or recession stalks the world.

Consider what a compliance officer is good at:

- Identifying and interpreting regulatory changes

- Assessing risk

- Crafting policies for large groups of people

- Conducting investigations

- Training people on the importance of certain types of behavior

- Encouraging people to speak up about risks they see

- Auditing compliance with corporate policies

My question is simply, in what world of 2030 or beyond will those capabilities become less important? What economic scenario could arise where management teams won’t need strong risk assessment capabilities, or investigations will become less important, or training people on how to behave will matter less? When will corporations want employees to keep quiet about mistakes they see happening, rather than raise those concerns?

The answer is none. Our world is getting more complicated, more inter-dependent, and more risky. The skilled application of compliance-like capabilities is only going to become more important for corporate success.

Yes, we somehow need to cut through the Gordian knot of modern hiring, which is a godawful mess. Yes, the economy might slip into recession and might make life miserable for lots of people for a while; or yes, you in particular might run into a string of bad luck that makes your life miserable for a long time. And yes, AI will transform how people work, although I suspect AI will not deliver anywhere near the benefits or disruptions that its enthusiasts and pessimists preach.

Those are all forces beyond our control — but the basic need for compliance capabilities is beyond corporations’ control. They’re going to need it today, tomorrow, and beyond.