Compliance and Incentives, Part II

Today I want to return to the idea of effective incentives for corporate compliance. In a post on the subject last week, we explored some fundamentals of how to build an incentives program, but struggled with exactly how to tie executive compensation to compliance criteria. So for help, I turned to that fount of all wisdom these days: ChatGPT.

Turns out, ChatGPT had some pretty good ideas.

My prompt for ChatGPT was simple enough. I told it that I was a chief compliance officer at a large manufacturing company, looking for ethics and compliance criteria to grade executives at the vice president level and above. What criteria could I use to tie their incentive compensation to ethics and compliance performance?

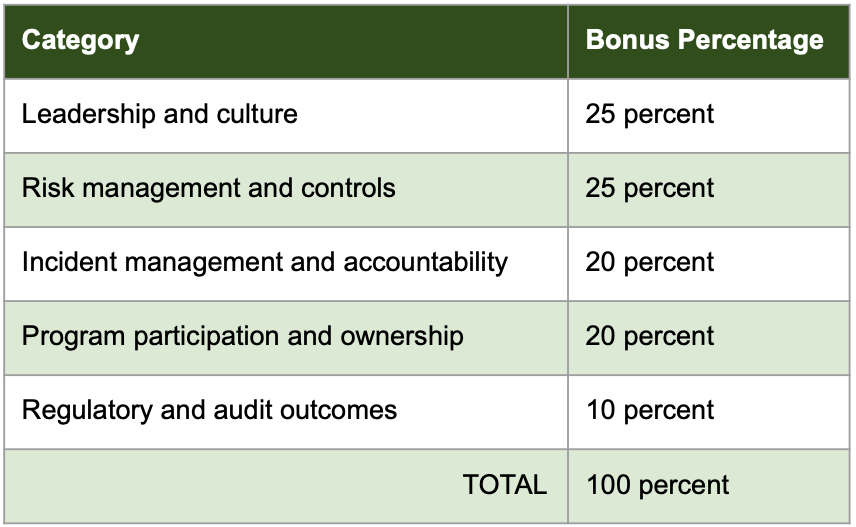

ChatGPT first broke down that broad idea into five more specific categories:

- Leadership and culture

- Risk management and controls

- Incident management and accountability

- Program participation and ownership

- Regulatory and audit outcomes

For each category, ChatGPT then gave three objectives. Each objective had a performance measure, a target to achieve, and examples of evidence that a CCO could use to see whether the executive hit the objective.

Each of the five categories also counted for a certain percentage of the total bonus amount. For example, leadership and culture accounted for 25 percent of the bonus, while regulatory and audit outcomes were only only 10 percent of the bonus. In theory, you could design your incentives program so that all five criteria were each worth 20 percent of the total, but I’m not sure that would ever make sense. For most executives in most industries, leadership does matter more than regulatory outcomes; so yes, you’d want to skew your incentive structure toward that category.

Each of the five categories also counted for a certain percentage of the total bonus amount. For example, leadership and culture accounted for 25 percent of the bonus, while regulatory and audit outcomes were only only 10 percent of the bonus. In theory, you could design your incentives program so that all five criteria were each worth 20 percent of the total, but I’m not sure that would ever make sense. For most executives in most industries, leadership does matter more than regulatory outcomes; so yes, you’d want to skew your incentive structure toward that category.

Then again, for some executives in highly regulated industries, I could see the case for giving more weight to regulatory and audit outcomes. Compliance officers should, as always, take a thoughtful, risk-based approach to designing incentives, which of course is what regulators want to see anyway.

Examples of Incentives

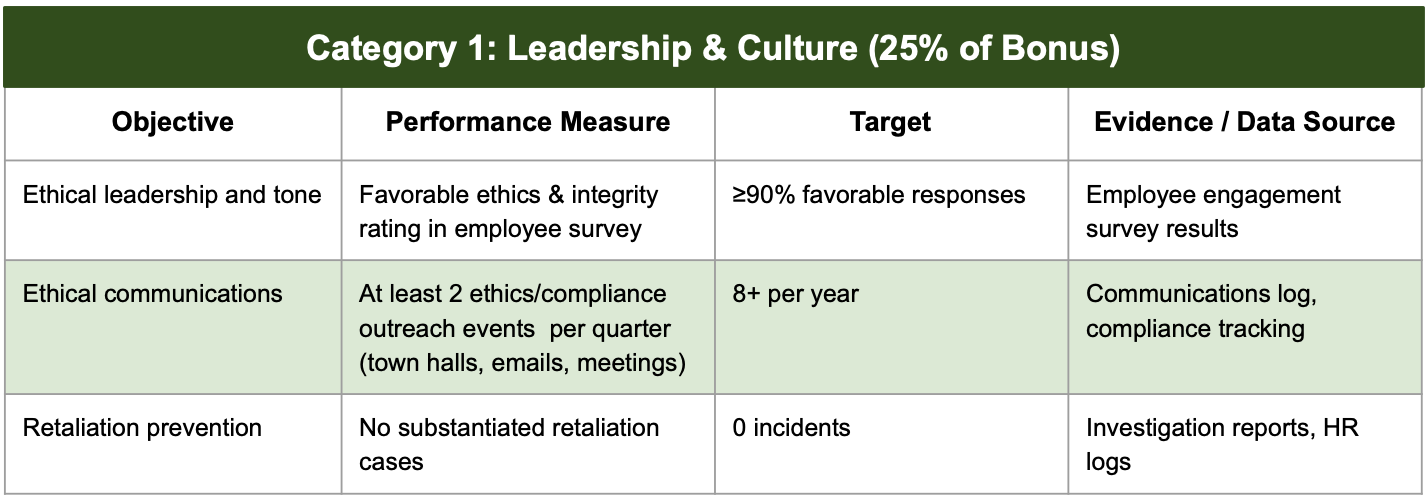

OK, onto the good stuff. Below is the framework for Category 1, Leadership and Culture.

This is good stuff. It’s a neat, self-contained unit framework that provides easy-to-understand criteria any compliance officer can use to drive more ethics-oriented behavior among the executive ranks. At the least, it gives your brain an, “Oh, now I get it” kick in the rear to grasp how you should approach the task. Then you can use this framework as a model for your own work and more productive conversations with HR and senior leaders in the business functions that might fall under your incentives program.

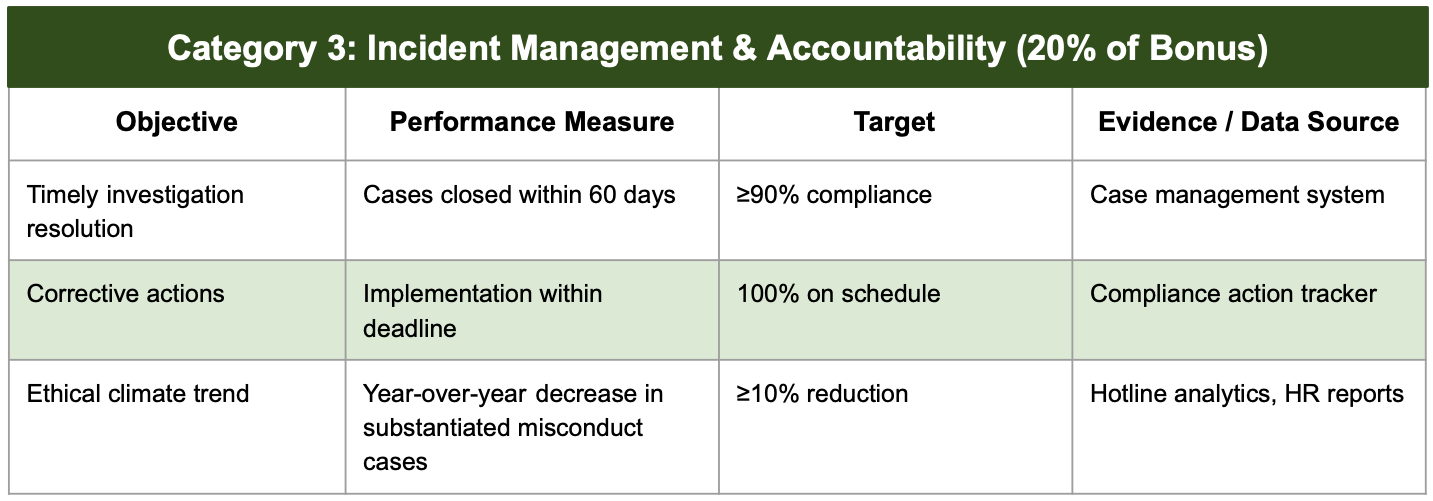

Here’s another example framework for Category 3, Incident Management and Accountability…

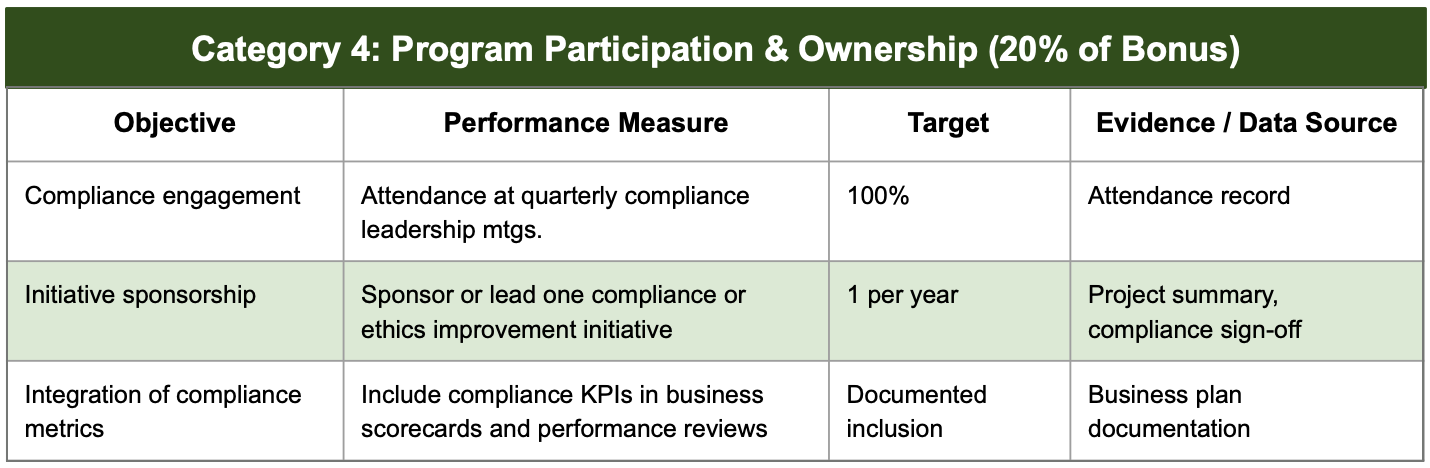

And another for Category 4, Program Participation and Ownership.

If you look at the Category 4 framework closely, you can see that even ChatGPT’s suggestions can sometimes be somewhat vague. For example, under that “integration of compliance metrics” objective, the performance criteria is “includes compliance KPIs in business scorecards.” Well, exactly which KPIs? Won’t they need their own performance criteria too?

You get the point: ChatGPT’s suggestions are good, but generic. Many times you’ll still need to color in the details yourself based on your organization’s own risk profile and in consultation with others. Overall, however, this is a good example of how compliance officers can use AI as a tool — something that provides raw material you can then sculpt into a final product suitable for your specific needs.

Other Incentive Concerns

OK, so you have a framework to tie executive compensation to ethics and compliance criteria, and you’ve honed that framework’s details so they’re a good fit for your specific organization. What else do you need to consider?

First, at the practical level, you’ll need clear processes and criteria for when a performance objective can be declared “met.”

For example, go back to the framework for Category 1, Leadership. One of the performance criteria is “at least two ethics/compliance outreach events held per quarter.” Does that mean two events expressly and solely devoted to compliance? Or could an event count toward that goal if the executive in charge talks about ethics and compliance as part of the overall discussion? If so, then what percentage of the total must be devoted to ethics and compliance? And so forth.

The last thing you need is HR or some senior VP arguing that, yes, Executive X has met some compliance objective and therefore deserves a bonus, when you believe Executive X hasn’t. Ideally your incentives framework will include as many specific, objective, data-driven performance measures as possible; but anticipate the potential for disagreement and what a resolution process for those disagreements could look like.

Second, think strategically about how much of an executive’s total bonus will be tied to compliance criteria.

That is, even if some portion of the executive’s incentive pay is tied to ethics and compliance, other portions will be tied to other goals, such as sales quotas or earnings per share goals or successful IT implementations. If those other portions are a large enough piece of the total pie, maybe the executive won’t have enough incentive to care about compliance; he or she can make more money by pursuing other goals.

So could you craft an incentive structure where compliance criteria affect the whole bonus? For example, perhaps if Executive X misses his compliance goals, then the entire bonus is reduced by 10 percent. You might need a compensation expert to hammer out the right details, and you’d need strong senior management support for something like this since you’re weaving ethics criteria so deeply into the compensation plan. But the risk you want to avoid — that compliance incentives become a rounding error compared to other incentives — is clear.

Along similar lines, think about whether your firm’s overall structure of executive compensation might erode the importance of compliance incentives over time.

For example, say you’re a publicly traded company that gives executives large equity grants. In one sense that’s sensible; it aligns their interests with shareholders, who want to see the share price increase over time.

On the other hand, as years go by and the executives’ equity accumulates, more of their overall wealth will be tied to an increasing share price. History is littered with examples of executives behaving badly so they could cash out a big equity holding before everything unravels, so your incentive compensation plan needs to account for risks like those, too (whether that’s through clear and aggressive clawback policies or some other mechanism).

Anyway, lots of issues to consider here. Clever use of AI might get you started, but you’ll still need human brainpower to find a solution that works.