Justice Dept. Promises More Declinations

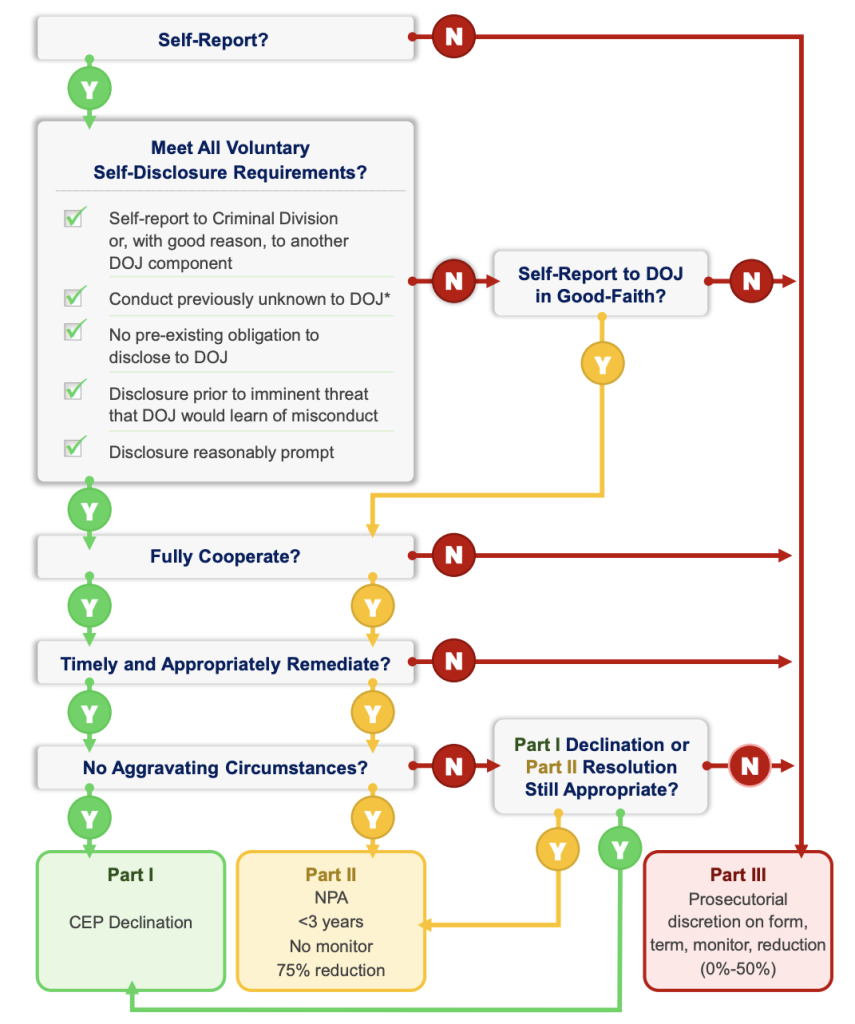

The Justice Department has announced new, more relaxed policies for when it will prosecute corporate crime, promising “a clear path to declination” that bypasses the criminal resolution process entirely for companies that self-disclose and remediate their misconduct.

Matthew Galeotti, acting head of the Criminal Division at the Justice Department, announced the new policy in a speech he delivered Monday. In many ways the new policy follows previous corporate enforcement policy under the Biden Administration, with an emphasis on voluntary self-disclosure, cooperation with prosecutors, and timely remediation of the offenses.

This new policy goes even further, however, clearly states that companies meeting all three criteria will receive a declination, not just the “presumption of a declination” standard that had existed previously.

Galeotti

“Those companies that meet our core requirements — voluntarily self-disclose to the Criminal Division, fully cooperate, timely and appropriately remediate, and have no aggravating circumstances — will not be required to enter into a criminal resolution,” Galeotti said. “This is a clear path to declination.”

Galeotti even threw a bone to corporate offenders in tricky situations, such as (a) companies whose misconduct includes aggravating circumstances (say, the involvement of senior executives or prior bad behavior); or (b) companies that did self-disclose but the department already knew about their misconduct thanks to a whistleblower.

Even companies in those predicaments will still receive at least a non-prosecution agreement, a promise of no compliance monitor, and a 75 percent discount in corporate penalties. They could also be eligible for a full declination “based on weighing the severity of those aggravating circumstances and the company’s cooperation and remediation,” Galeotti added.

And for anyone confused about all these changes and how the Justice Department wants you to proceed, the department even released a nifty flow-chart to help you decide! See below.

Source: Justice Department

More Relaxed Monitorship Policy, Too

Galeotti also announced new policies for compliance monitors. Basically the department wants to use monitors much less often, because “the value monitors add is often outweighed by the costs they impose.”

That should not be a surprise; the Justice Department has ended numerous monitorships ahead of schedule since the Trump Administration arrived, although at least a few of them still seem to be in force — and to that point, Galeotti did say that monitorships will not disappear entirely.

“In limited circumstances,” he said, “a narrowly tailored monitorship that is right-sized to the conduct it seeks to remedy can be an effective resource to provide independent oversight and review to companies that are struggling to implement effective compliance programs on their own.”

So how will prosecutors evaluate whether a monitor is necessary? Galeotti listed four criteria:

- The nature and seriousness of the conduct, and the risk that it will happen again. In analyzing the nature and seriousness of the conduct, the prosecutors “will focus chiefly on harms to Americans and American business.” (This immediately makes me wonder about monitors for FCPA offenses, or really any violation that happens overseas.)

- The availability of “other effective independent government oversight,” such as a regulator. (Does that mean the Justice Department itself, perhaps accepting annual progress reports, as we’ve seen in other recent resolutions? Unclear.)

- The effectiveness of the company’s compliance program and culture of compliance at the time of resolution.

- The maturity of the company’s controls and ability of the company to test and update its compliance program.

Moreover, the Criminal Division “will ensure that costs are proportionate with the underlying criminal conduct, the company’s profits, and the company’s size and risk profile,” Galeotti said, by requiring a cap on monitors’ fees, approval for all budgets and workplans, and biannual meetings anong the department, the monitor, and the offending company.

Plus, remember that most corporate offenders will never even get to this monitorship stage, because you’ll have a declination.

Not Discussed: Compliance Programs

One thing Galeotti did not say was anything significant about corporate compliance programs or the department’s guidelines for evaluating them.

Galeotti did deliver his remarks at an AML compliance conference hosted by SIFMA, the trade association for investment funds, so he included all the obligatory cheerleading for compliance officers that Justice Department officials always give at these sorts of events. “Those of you in an AML compliance role are on the front lines defending your companies against criminal actors,” he said. “You work every day to implement systems to keep your companies, your customers, and your shareholders safe.”

That’s nice to hear — but if the Justice Department sees compliance officers and strong compliance programs as critical allies in the fight against crime, it needs to convey both the value of having a strong compliance function and the consequences for a company that doesn’t take ethics and compliance seriously.

I’m not clear on how much Galeotti’s new policies do or don’t undermine that idea.

The good news is that a company still only receives a declination if it meets all three prongs of the corporate enforcement program, and one of those prongs is timely and appropriate remediation. Under the Galeotti standard unveiled this week, “timely and appropriate remediation” includes implementing an effective compliance program. The Galeotti standard then lists eight criteria for an effective program, and they all align with the elements of an effective program according to the U.S. Sentencing Guidelines.

OK, nice theory. So how will prosecutors make that assessment in practice? Wouldn’t such an assessment typically be part of the resolution process — the very same process that Galeotti says companies will now be able to avoid? Like, someone at the Justice Department will need to examine the state of the company’s compliance program. Who will do that, how vigorously, and at what point in time? Especially when the department has either laid off a bunch of people or re-tasked them away from corporate criminal enforcement anyway?

That’s the part where I’d like to see more from Galeotti. Maybe we will; for example, Galeotti’s new policy says all declinations under the corporate enforcement policy will be made public, and perhaps those declinations will include a discussion of compliance program improvements that others can read and consider.

The proof will be in the pudding. I don’t think I’m wrong to be skeptical.