Report Warns on SEC Disclosure Reviews

A report from the Securities Exchange Commission is raising alarms about the SEC staff’s ability to review corporate disclosures, amid painful personnel cutbacks and changes to the regulatory climate that might lead to even more work for those fewer SEC staffers still on the job.

The report, released Wednesday by the SEC inspector general, found that nearly 10 percent of the SEC staff dedicated to reviewing corporate filings have left the agency since February, and still more are eligible for early retirement benefits. If the SEC decides on further personnel cuts, “additional employee departures may occur and lead to a loss of institutional knowledge,” the report said. And when that part of the SEC is able to hire again, “inconsistent documentation and a lack of comprehensive guidance may pose challenges for newly hired staff.”

Translation: you, director of SEC reporting or SOX compliance or corporate disclosures, will have a more frustrating time getting clear, timely answers from the SEC about whether your filings pass muster.

For background, the Sarbanes-Oxley Act says that SEC staffers must review every company’s corporate filings at least once every three years. Those same staffers also perform more frequent “elective” reviews of companies based on a variety of risk factors that the agency is supposed to announce each year. For example, the SEC might decide to review the disclosures of companies more exposed to inflation in one year, and the disclosures of other companies the following year more exposed to a new accounting standard.

These reviews are done by the agency’s Disclosure Review Program (the DRP), managed within the Division of Corporation Finance. When DRP staffers do have questions about a company’s disclosures, they send the company a comment letter.

Then comes a back-and-forth between your corporate disclosure team and the SEC. That correspondence could drag on for several months as you either (a) explain why you disclosed something the way you did, or more likely; (b) you say, “OK, fine, whatever” and do what the SEC asks so they’ll go away. Ultimately all those comment letter chains become public, and they provide useful guidance for other corporate filers wondering how to disclose a tricky issue.

The inspector general’s report mostly focused on how the SEC selects the risk factors for its elective reviews, and urged the agency to provide more transparency and consistency on that front. OK, fine, whatever; I’m more interested in the personnel shortages, since that’s where corporate filers will feel the pain.

Fewer Staffers, More Work

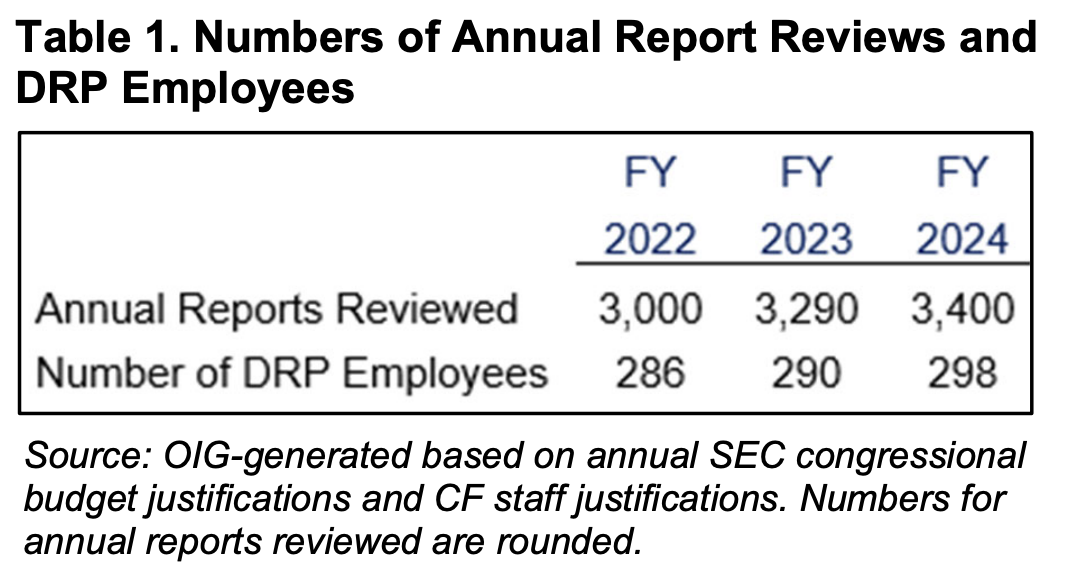

The inspector general counted 299 employees in the Disclosure Review Program at the start of this year. Since then (read: since Trump 2.0 took over) 27 of those employees have left the agency through voluntary early retirement. That’s 9.9 percent of all personnel for the program, and even more employees are still eligible for early retirement if the agency imposes more personnel cuts.

At the same time, the Trump Administration is pushing several regulatory moves that could well end up giving the Disclosure Review Program even more work to do. Most notably, the SEC is working on a regulatory framework to bolster the cryptocurrency industry. When that framework arrives, and it paves the way for more firms to offer more crypto-related offerings — well, those offerings will need to be reviewed by DRP staffers somehow. So will new confidential filings or new offerings from entrepreneurs who might be raising capital through newly relaxed rules.

At the same time, the Trump Administration is pushing several regulatory moves that could well end up giving the Disclosure Review Program even more work to do. Most notably, the SEC is working on a regulatory framework to bolster the cryptocurrency industry. When that framework arrives, and it paves the way for more firms to offer more crypto-related offerings — well, those offerings will need to be reviewed by DRP staffers somehow. So will new confidential filings or new offerings from entrepreneurs who might be raising capital through newly relaxed rules.

All of that would result in more work to be done by fewer DRP staffers. Plus, the ones who do remain on the job are likely to have less institutional knowledge about tricky disclosure matters or nuanced accounting treatments.

The practical upshot for SEC filers, then, would be longer, more uncertain conversations with the SEC when you do receive a comment letter; but also perhaps a greater chance that you won’t receive a comment letter at all because the staff won’t have enough time to give disclosure reviews much thought.

SEC leadership did concede that staff reductions and additional workload “could place additional strain on existing resources and result in a loss of valuable institutional knowledge.” The SEC then said the agency is “considering the development of a broader proactive plan to help mitigate the potential workload balances and continued attrition” — which sounds to me like they’re telling themselves, “Hey, let’s just have AI do all this!”

Never mind that when the inspector general polled Disclosure Review Program employees about whether the work could be automated, only 22 percent said they thought automation could work well. I’m sure those DOGE 20-somethings who have never even read a corporate report know better than the 30-year veteran employees.