SEC Kicks Climate Rule to 2024

The Securities and Exchange Commission has pushed adoption of its greenhouse gas disclosure rule to April 2024, confirming what everybody already knew: the agency’s progress on a final text is mired in debate about how to handle greenhouse gas emissions from a company’s supply chain.

The Biden Administration published its Fall 2023 regulatory agenda on Wednesday, including numerous updates on pending rules from the SEC. Tucked away in that announcement was confirmation that a final climate change disclosure rule isn’t likely until next April.

The SEC first proposed its climate change disclosure rule in March 2022, with the hope of enacting a final rule perhaps by early 2023. Except, the proposed rule was one of the longest and most complicated in SEC history (490 pages); and subsequently received more comments than any proposal in SEC history (thousands upon thousands, although many of them are form letters both for and against the proposal).

SEC chairman Gary Gensler has lately been cagey about when the proposed rule might come up for a final vote, and how the final text might differ from the original. Well, now we know that the agency is giving itself another five months to figure out what to do.

We should also note that even the April 2024 date isn’t ironclad. The SEC could adopt a final rule sooner if it somehow does complete a final text; or it could push the deadline yet again — although stalling such a politically sensitive rule into late 2024, the thick of a presidential election, seems rather risky to me. Plus, pushing final adoption into 2025 seems even more risky, since right now there’s a 50-50 chance Republicans will be in the White House by then, and they’ll kill this rule faster than Donald Trump goes through skin bronzer.

Why the Climate of Delay?

All evidence suggests that the delays here are about how the SEC wants to handle so-called Scope 3 emissions. Those are the greenhouse gasses created by your supply chain, both upstream (created by your suppliers as they provide goods and services you need) and downstream (created by your products once you sell them to customers, such as automakers tracking tailpipe emissions from cars they sell).

Calculating Scope 3 emissions will be a bear of a task for many companies, especially small and mid-sized firms that might need to calculate their emissions as part of providing services to their public-company customers. Little surprise, then, that in recent weeks SEC officials have reportedly been telling the business community that the final rule’s Scope 3 requirements will be significantly scaled back from the original proposal.

Calculating Scope 3 emissions will be a bear of a task for many companies, especially small and mid-sized firms that might need to calculate their emissions as part of providing services to their public-company customers. Little surprise, then, that in recent weeks SEC officials have reportedly been telling the business community that the final rule’s Scope 3 requirements will be significantly scaled back from the original proposal.

There’s also the matter of other climate disclosure rules coming into force, and whether the SEC should align the arrival of its new rule with them. For example, California’s new climate change disclosure rule goes into effect in 2026, as do the European Union’s new ESG reporting standards. The SEC stalling until next spring, so that its new rule can go into effect in 2026 too, does have a certain appeal.

What Does This Mean for Companies?

Perhaps not much, especially for large companies. You already know climate change disclosures are coming for your enterprise eventually, whether that’s from Europe, California, activist investors, or consumer pressures. Many large companies either already provide some climate change disclosure, or they’re preparing to do so in the immediate future. None of that is likely to change just because the SEC is stalling its final rule for another few months.

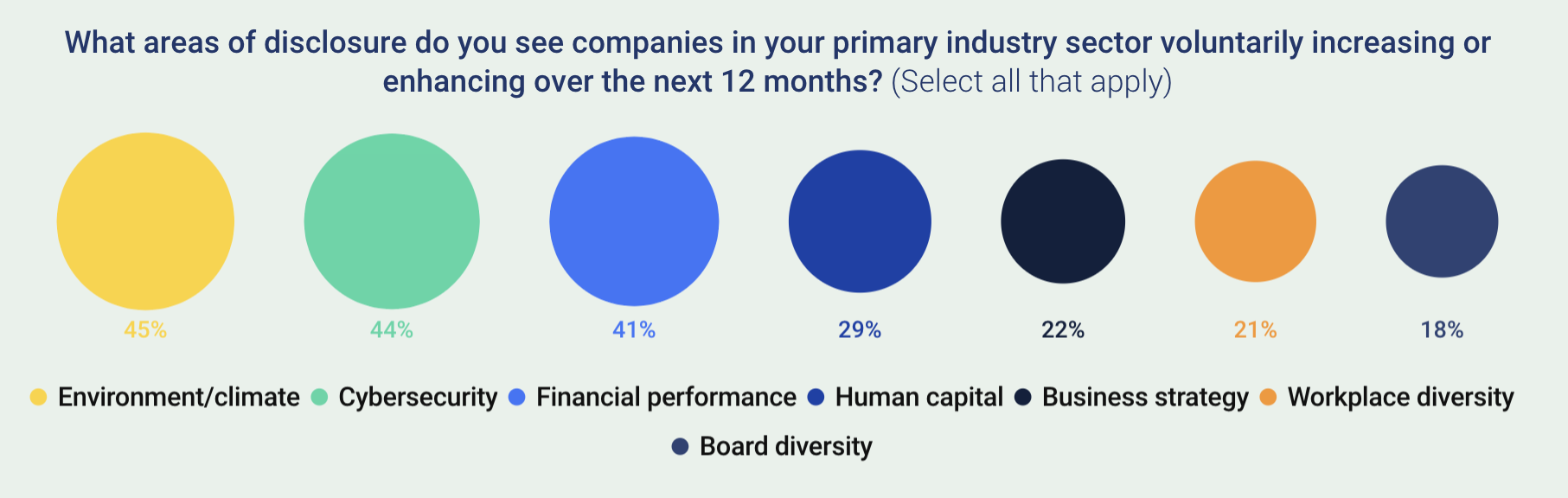

Indeed, just this week the Center for Audit Quality (a lobbying voice for large accounting firms) released its 2023 Audit Partner Pulse Survey, where it surveyed audit partners about the issues they see at the forefront of their client companies’ minds. Forty-five percent of respondents said they expect their client companies to disclose more information about environmental or climate issues in 2024, more than any other issue on the 2024 radar. (See Figure 1, below.)

Source: CAQ

In other words, the SEC delay might give you more time to proceed down the path to greater disclosure of greenhouse gasses and other climate factors — but you’ll still need to go down that path. The same ESG disclosure and audit issues that have flummoxed companies already are still there.

- Do you fully understand the climate change proposal in the first place, such as which gasses must be tracked and how other disclosure protocols fit into the SEC’s thinking?

- Do you have an ESG reporting structure, and is that structure wise given all the other reporting and assurance duties you already have?

- Have you considered any frameworks to guide your sustainability reporting, such as the framework COSO released earlier this year?

Use your time wisely.